The full form of SOX includes eleven sections. Those having the most impact on businesses embarking on a SOX implementation are described below.

SOX 302

Corporate Responsibility for Financial Reports

Section 302 requires public companies to file financial reports with the SEC. Those reports must be signed by the CEO and CFO, both of whom are held responsible for report accuracy. The officers are required to attest that the reports are correct and include all essential information. Companies must have internal controls to prevent erroneous information, and the officers must attest that those controls had been validated within 90 days of the report.

SOX 303

Improper Influence on Conduct of Audits

“Materially misleading” statements are at the heart of this section, which forbids misleading, coercing, manipulating, or influencing auditors. Doing so can result in civil penalties enforced by the SEC.

SOX 401

Disclosures in Periodic Reports

This section declares that annual and quarterly financial reports filed with the Commission must include material off-balance-sheet transactions, arrangements, and obligations, even if those obligations are contingent. The rule ensures that changes in financial condition, liquidity, capital expenditures, and resources are transparent to investors.

Section 401 also stipulates that reports should not contain any misleading statements, let alone untrue statements or errors of fact.

SOX 404

Management Assessment of Internal Controls

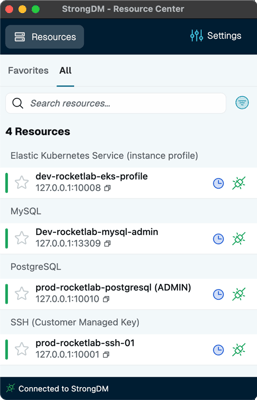

Management is accountable for adequate internal controls. Both management and external auditors report on the adequacy of controls and report gaps. Since 2007, the SEC has helped small businesses by issuing its own guidance on internal controls, so companies have an easier time compiling their own SOX 404 compliance checklist. SOX 404’s meaning is that teams are accountable for internal controls, so they need tools to confirm reports or face SOX penalties for false reporting.

SOX 802

Criminal Penalties for Altering Documents

Employees who make changes to a financial document that can affect the SEC’s administration, or who conceal or falsify a record, are subject to criminal penalties from fines to imprisonment for up to 20 years.

SOX 806

Protection for Employees of Publicly Traded Companies Who Provide Evidence of Fraud

The section protects the employees and officers of a company who knowingly aid an investigation, come forward with information, testify in an investigation, or cause information about a company’s financial fraud to be released. Employees are protected from losing their positions and from harassment, demotion, suspension, or any other discrimination. Section 806 outlines compensatory damages for SOX violations.

SOX 906

Corporate Responsibility for Financial Reports

Employees who submit false or misleading reports in violation of SOX are subject to criminal penalties, including fines or imprisonment, for up to 20 years. The full form of SOX delineates individuals who are responsible, with contractors, employees, agents, and execs all playing a part.

SOX 1107

Retaliation Against Informants

Further strengthening protections against whistleblowers, this section sets federal criminal penalties of fines or less than ten years' imprisonment for retaliating against an informant. That includes taking any retaliatory action against their person or employment.