strongDM raises $17M Series-A Led by Sequoia Capital to Embed Secure Access Into DevOps’ Infrastructure-As-Code Movement

Burlingame, CA -- October 27, 2020 -- strongDM, the single sign-on (SSO) company for backend infrastructure, today announced a $17 million Series A financing round led by Sequoia Capital, with participation from all prior investors. Doug Leone, Global Managing Partner at Sequoia Capital, has joined the company’s board of directors.

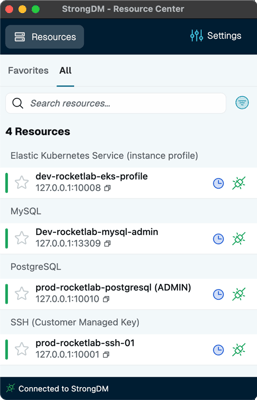

The cloud unleashed an explosion of databases and servers, hosted in more places and accessed by more people. While DevOps professionals have automated most manual processes, providing secure access to infrastructure has always been an exception.

“Just like AWS for compute power, and Kubernetes for container orchestration, strongDM is the gold standard for access and auditing,” said Drew Blas, Director, Internal Engineering at Betterment. “Developers won’t tolerate tools that slow them down or force them to use substandard workflows. strongDM is the only security product that actually makes their lives easier.”

Traditional network security just doesn’t work at the scale that ephemeral infrastructure demands, nor with today’s distributed workforce. “That’s why VPNs aren’t enough. It’s why a bank doesn’t just lock the front door. There’s also a vault, and security cameras to see what someone's doing when they're inside,” says Elizabeth Zalman, strongDM co-founder and CEO. Access and auditing can no longer be a manual process. They must be designed into the development lifecycle through code.

“While SSOs solved the authentication problem for web applications more than a decade ago, there has never been an equivalent for backend infrastructure,” said Leone, Sequoia partner and strongDM board member. “We partnered with strongDM because we believe that any company with a database or server needs this product. It’s no surprise that their customers are obsessively loyal.”

More than 100 companies have strongDM in production today, ranging from the Fortune 50 to the fastest-growing tech companies, such as Peloton, SoFi and Betterment.